DFG is Loyal Only To You

Diversified Financial Group of Lakeville is an independent financial services firm founded in 2009. Originally a broker at Merrill Lynch, I wanted to redesign an investment firm without all of the typical conflicts of interest you find in a wall street firm relationship. DFG of Lakeville was formed with the goal of providing an investment strategy where everyone’s interest are aligned. My financial advice and investment planning solutions are tailored to fit the unique interests of each client, while also in a scalable format where each client gets the same execution as the next no matter the size of the portfolio. DFG of Lakeville specializes in portfolio management for individuals and corporations.

From trust management, IRA’s, individual accounts, JTWROS, 529, to qualified and non-qualified corporate plans. My firm also utilizes various insurance arrangements to save money on taxes, help protect legacy wealth, and provide secure retirement income streams. My core values of integrity, loyalty, and independence guide every interaction with clients. I am committed to professionalism and objectivity in our customer service and planning process. My independence permits me to provide the highest level of integrity in my advising process. My firm has no corporate interests or sales quotas to consider. DFG is loyal to only you!

About Jake Kettwig

Jacob is a Financial Advisor in the Lakeville Minnesota office of Diversified Financial Group. He has over 17 years of experience in overseeing the financial affairs of high net-worth families and small businesses. He holds the Chartered Retirement Planning Counselor℠ designation from the College of Financial Planning. In addition to his CRPC® designation, Jacob has a Bachelor’s degree in Finance from the G.R. Herberger School of Business, Saint Cloud State University. Jacob maintains Series 7 & series 66 securities registration and is registered as an Investment Advisor Representative with Cambridge Investement Research Advisors, Inc. He is also licensed in life insurance, annuities, long-term care, accidental death and disability insurance, and health insurance.

Jacob resides in Lakeville Minnesota and enjoys water sports, fishing, hunting, and hanging out with his daughter Victoria and son Carter as well as his friends.

Check the background of investment professionals on FINRA’s BrokerCheck.

Our Process

The Diversified Financial Group Managed Account is a discretionary asset management account that allows the firm to proactively manage your account as investment advisor representatives of Cambridge Investment Research. Here is a look inside the new investment strategy.

4-Step Investment Management Process

STEP ONE

Create portfolios based on asset and sector classes believed to be in a long-term uptrend. Identify and capitalize.

STEP TWO

Monitor and evaluate non-proprietary investment vehicles for utilization in your portfolios.

STEP THREE

Utilize multiple quantitative analysis tools to optimize the buy/sell decision-making process.

STEP FOUR

Monitor and evaluate legal insider buying analysis to enhance market entry and exit points. Track what company insiders are doing with their own money.

Asset Classes & Sectors

- Precious metals

- Broad based commodities

- Large capitalization stocks

- Emerging market securities

- Market neutral strategies

- Convertible bonds

- Treasury Inflation-Protected Securities

- Municipal bonds

- High-yield bonds

- Corporate bonds

- Government securities

- Managed futures

- Energy

- Agriculture

- Industrial metals

- Battery metals

Risk Management

The recent turmoil in the worldwide financial markets has reiterated the need for diligent risk management. My firm’s managed account allows him to more effectively monitor the risk level in the market. When I believe the risk is too high, I have the capability to take action to try to mitigate that exposure on your behalf.

As investment analyst Louise Yamada said, “There are two kinds of losses. A loss of capital and a loss of opportunity; but there will always be another opportunity if you protect capital.” I am very conscious of trying to protect your money during times of anticipated negative volatility. That way, we will have the capital to invest when new opportunities arise.

DFG is excited about the opportunity to serve you. I believe this partnership will help maximize your investment results while offering the personalized service you’ve come to expect.

Our Services

Financial Planning

If you are curious, let me run the numbers and see how close you are to being able to retire. Financial planning outcomes can quickly become outdated if markets change outside of expectations, if your life situation changes, or if your current advisor ran the numbers based on unrealistic inflation expectations or returns. Should I pay off my mortgage or stay in debt? I can help you answer these questions so call me today!

Retirement Income & Tax Planning

Qualified and Non-Qualified Plans

One of my core competencies is tax sheltered corporate plans and executive bonus arrangements. I can bring managed solutions, as both an ERISA 3(21) advisor as well as an ERISA 3(38) specialist. What this means is that I am able to build and maintain a managed model solution as an investment options choice. This turn-key solution for plan participants and employers is an incredibly power solution that is almost unheard of in the 401k space.

Read More

If you desire ERISA 3(16) services as well, I can integrate that into your payroll services as a turn-key solution for your HR manager or Corporate Controller. This mitigates, contractually, the liability and fiduciary responsibility from the corporate employee that manages the back end of the plan. Call me today to set up a time where I can illustrate exactly what I can offer.

Investment Strategies & Philosophy

Read More

Oil and gas drilling programs & pipelines, gold and silver, clean energy, fixed index annuities, CTA exposure, and real estate, are a few outside the box the ideas I offer. Separately managed solutions to third party money managers and mutual fund strategies are also available. Mike Tyson once said, “Everyone has a plan, until they get punched in the face”. Today, most advisors use “Modern Portfolio Theory”. That’s a neat little way to allow them to “buy and hold” while doing as little as possible when it comes to actually mitigating risk in the market and your portfolio. It works until it doesn’t, and when it doesn’t the results can be catastrophic. I learned this as a young man at a big Wallstreet firm. My sales manager told me that if I didn’t keep my clients invested I wouldn’t get paid and after 3 months my payout/fees would be cut down, and I would lose my job shortly thereafter. In the meantime, we were forced to sell every CDS, MBS, Fannie Mae preferred share they had inventory to our clients. Why? Because you cannot be a fiduciary if you are publicly traded with shareholders. I didn’t listen and shortly thereafter quit and started my own firm. Wallstreet firms and other big “product distribution” companies that you see on every street corner are today’s fast food market for investors and they are just as unhealthy. Every one has a guy, and your guy or gal is probably a very nice person, but it’s possible and very likely the firm he works at does not allow him to do the right thing without first sacrificing himself and his own interest. Everyone’s financial interest should be aligned, and if they are not, it should be required for it to be disclosed! Call me today if you think you need a second opinion!

Common Sense Investing

Investing only works if you get to keep the profits. Investing 101 tells us to “Buy low and Sell high,” NOT to buy and hold forever. Too often we hear, “Just hang in there, it’ll come back.” That’s great, IF one can wait long enough for the assets to recover! The markets and economy go through constant up AND down cycles. If one needs their capital and the markets happen to be in a down cycle, it could be a painful time to withdraw assets. More importantly, it would be difficult to sit by and watch all of your hard-earned gains evaporate just because the market is falling.

No To Buy & Hold

I believe in tactical asset management that takes into account the changing market, your income needs, and your goals. I do not believe in a “set it and forget it” strategy for investment management.

No To Buy & Hold

I believe in tactical asset management that takes into account the changing market, your income needs, and your goals. I do not believe in a “set it and forget it” strategy for investment management.

Our Portfolio Strategy

My process does not rely on favorable conditions in any particular market, sector, or asset class.

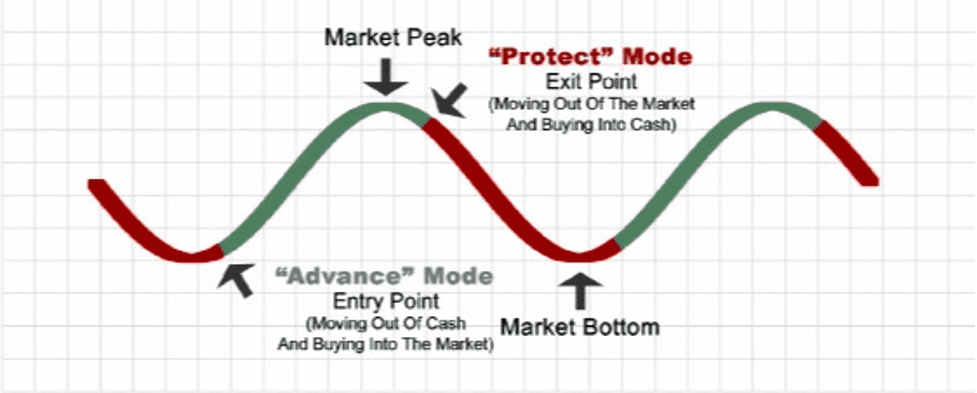

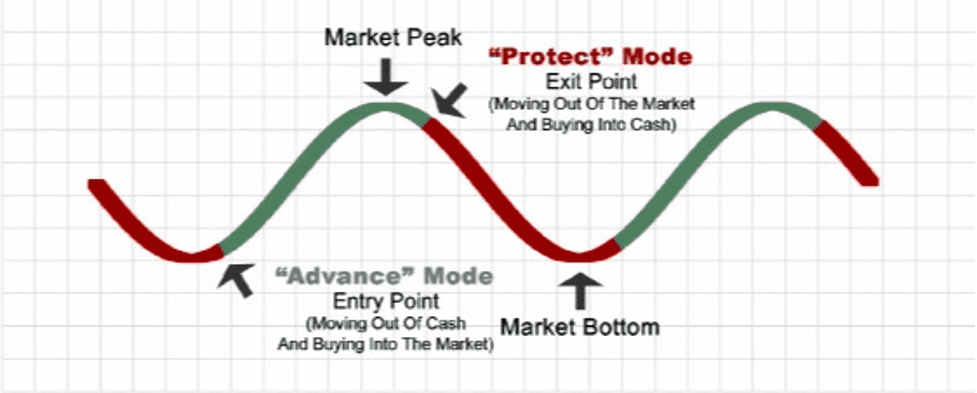

“Advance and Preserve” is the portfolio strategy that we implement. It can be thought of as very much the opposite of “Buy & Hold,” however, more specifically; I like to think of it as “A defensive model with an offensive strategy” – both a buying strategy and more importantly, a sell strategy. You may have heard of “stop-loss orders” in the past – this is where you pick a price at which you plan to sell out of a security if it goes too low. Well, my goal is to take things further than just having a bailout plan for our portfolios.

What does this mean? Perhaps it is easier to explain what it does not mean. It means that I don’t “ride out the storm.” It means that I don’t implement a “set it and forget it” approach to your life savings that you have worked so hard to save up. Finally, it means that I don’t leave your portfolios to be managed by chance, in hope things will come back when we want them to (hopefully sooner than later).

How Does DFG Do It?

My firm uses a compilation of software suites that range from tools for asset allocation, fundamental analysis, and investment filtering systems, legal insider buying analysis, all the way through stochastic modeling overlays (technical analysis). While the cost of these tools can be significant, I firmly believe that we can’t afford not to spend the money.

We’ve built numerous asset allocation models that range from models for those who are still in their “Accumulation Phase” of retirement planning to portfolios for those who are in their “Distribution Phase” of retirement income planning. Each of these models is tracked on a daily basis to help avoid any unexpected changes. The quantity of holdings in each portfolio is related to the investment objective of the portfolio at hand.

Once I’ve screened the qualitative and fundamental side of our model portfolios, I then feed this information to our technical analysis software that allows me to closely track, on a daily basis, every investment my clients own.

On the simplest of all levels, I track the movement of each investment that we own and look for potential opportunities to buy when it looks as if a bottom is beginning to form in a particular security. This is called “Buy Side” analysis. Similarly, and most importantly, I track the movement of each investment to look for opportunities to take profits off the table or cut losses against a security that I feel has a high probability of taking a downward plunge. This is known as “Sell Side” analysis, or having an “Exit Strategy,” and in my opinion, it’s one of the largest components that most other financial planning firms don’t address. I believe it may be one of the most important elements to successful investing. My goal is to not only make a profit, but keep the profit too!

With all that said, my strategy is not clairvoyant. I do not have a crystal ball. I will rarely buy at the exact bottom and sell at the exact top. Doing so is next-to-impossible. However, what I ideally want to accomplish is to buy early on the way up, participating in as much of the potential gains as possible – and then selling early on the way down, missing as much of the potential downside as possible. So, the goal is maximum upside-capture with minimum downside-capture.

What about fees? I charge a fixed annual percentage to each portfolio I manage, which is billed directly from the account on a quarterly basis.

Investing involves risk including the potential loss of principal. No investment strategy, such as asset allocation, can guarantee a profit or protect against loss in periods of declining values. Past performance is no guarantee of future results. Please note that individual situations can vary. Therefore, the information presented here should only be relied upon when coordinated with individual professional advice.

Technical Analysis is based on the study of historical price movements and past trend patterns. There is no assurance that these movements or trends can or will be duplicated in the near future. It logically follows that historical precedent does not guarantee future results. Conclusions expressed in the TA section are personal opinions; and may not be construed as recommendations to buy or sell anything.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Stop loss orders do not offer any guarantees against loss of investment. In most cases, the stock will be sold at a price that is close to the market price at the time the stop order is triggered. However, a stop order becomes a market order, so in some cases, the execution price could be significantly lower than the stop price.

Check the background of investment professionals on FINRA’s BrokerCheck.